Table Of Content

In her spare time, Miranda enjoys traveling, actively engages in the entrepreneurial community, and savors a perfectly brewed cup of coffee. When determining which lender to choose, make sure you review the Loan Estimate forms provided by each lender. Loan Estimates will give you a rundown of the terms of your home equity loan, including the interest rate, and itemize the closing costs and fees you’ll be charged. Once the repayment period begins, the HELOC borrower must make payments on both the interest and principal—usually over a 20-year period.

Getting A Home Equity Loan With Bad Credit

The prime rate represents one of the lowest rates that lenders will offer to their most attractive borrowers. When you’re shopping for a home equity loan, it’s smart to make sure your financials are in as good a shape as possible. This means pulling your credit reports from the three main credit reporting agencies — Experian, Equifax and TransUnion — and addressing any errors you find. You might also pay down any larger balances, which has the added benefit of improving your debt-to-income ratio. Most home equity loan rates are indexed to an industry base rate called the prime rate. This represents the lowest credit rate lenders are able to offer their most attractive borrowers, though most lenders will add a margin to calculate their final rate offer.

Best home equity loans for 2024 AP Buyline Personal Finance - The Associated Press

Best home equity loans for 2024 AP Buyline Personal Finance.

Posted: Tue, 16 Apr 2024 13:32:17 GMT [source]

The Bankrate Promise

This can offer some peace of mind — but because there’s no collateral securing a personal loan, they generally come with higher interest rates. Home equity loans have fixed interest rates, meaning you can enjoy consistent payments that won’t change over time. Once you’re approved, you can use the cash from a home equity loan to pay for almost anything — from home improvements to medical bills or other debts.

Can you get a home equity loan with bad credit?

HELOCs may have a minimum monthly payment due (similar to a credit card), or you may need to pay off the accrued interest each month. At the end of the draw period, you’ll need to repay the full amount you borrowed. When a homeowner takes out a home equity loan, the lender issues the entire loan at once and it is subject to a fixed interest rate.

Home equity loans in 2024

Our scoring methodology included capturing more than 10 data points, which covered interest rates, lender fees, discounts, accessibility and borrower requirements. As with any major purchase or loan, you may not get the best deal if you don’t shop around. Applying for home equity loans with multiple lenders could help you get a lower rate or lower fees.

When you take out a home equity loan, the lender approves you for a loan amount based on the percentage of equity you have in your home and other factors. You’ll receive the loan proceeds in a lump sum, then repay what you borrowed in fixed monthly installments that include principal and interest over a set period. Although terms vary, home equity loans can be repaid over a period as long as 30 years. Even though home equity loans have lower interest rates, your term on the new loan could be longer than that of your existing debts. With personal loan rates over 12% and credit card interest pushing 21%, homeowners who borrow against their equity can access funds at a relative bargain. While home equity closing costs can be similar to a home purchase loan or refinance, the total fee amount is generally lower since you’re financing a smaller balance.

Home equity line of credit (HELOC)

If you are unable to pay back the loan, you may lose your home to foreclosure. If you or your child qualify for federal student loans, you may get a lower interest rate than a HELOC’s rate. And federal student loan protections and flexible payment plans may make federal loans more advantageous.

Estás ingresando al nuevo sitio web de U.S. Bank en español.

Additionally, you may be subject to expensive closing costs and a more drawn-out application process. Another benefit of home equity loans is that they have competitive interest rates, which are usually much lower than those of personal loans and cash-out refinances. Home equity loans are often a better option if you know the amount you need already—say for a child’s education or a home construction project.

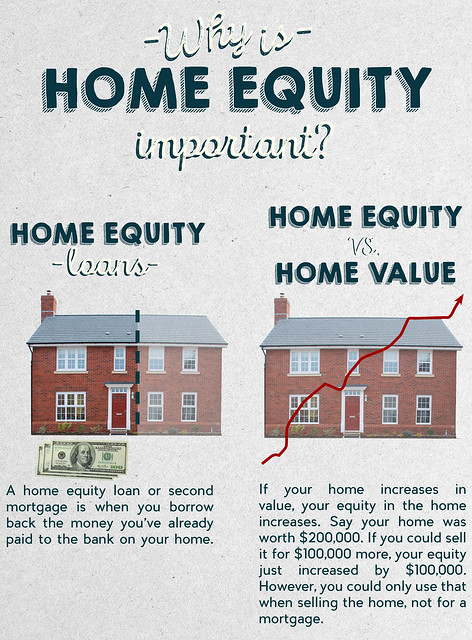

If you use the cash-out amount to pay off other debts, such as car loans or credit cards, then your overall cash flow may improve. Your credit score may even rise enough to warrant another refinance in the future. These loans are often used to pay for educational expenses, medical fees, other lump-sum expenses, or debt consolidation. The interest rates for second mortgages are usually much lower than for credit cards. For homebuyers who are interested in saving money through debt consolidation, a home equity loan can be a good option. Also known as a second mortgage or second lien, a home equity loan works by letting you borrow against the equity you have in your home.

There's still a total loan amount, but you only borrow what you need, then pay it off and borrow again. That also means you pay back a HELOC incrementally based on the amount you use rather than on the entire amount of the loan, like a credit card. According to property data provider CoreLogic, homeowners with mortgages across the U.S. saw an increase of nearly 16% in their equity year over year in 2022. This means that even homeowners who made small down payments or who have only owned their home for a few years may already be eligible for a home equity loan. Lenders rarely allow you to borrow 100% of your home’s equity for a home equity loan.

For example, if your home’s current fair market value is $500,000 and you owe $250,000, you have a 50 percent equity stake. While the housing sales have cooled in some areas in recent months due to higher mortgage rates, housing prices have continued to post gains – good news for the net worth of American homeowners. According to the Board of Governors of the Federal Reserve System, U.S. households possessed almost $32 trillion in home equity in the fourth quarter of 2023. That’s a record high, and it means that the vast majority of homeowners are sitting on a huge pile of equity that they can leverage to access cash, including through a home equity loan. If you need a large sum of cash on a revolving basis to fund your home improvements, a HELOC may be a good choice.

However, these rates still make home equity borrowing look downright attractive compared to the double-digit APRs attached to most other consumer financing options. And, there are a few other good reasons why it could make sense to tap into your home's equity to access cash right now. The period when you can spend money through your HELOC is called the draw period. After the draw period ends, you can longer access the credit, and you enter your repayment period.

That appraisal is no guarantee that the property would sell at that price. Home equity is an asset that you can borrow against to meet important financial needs such as paying off high-cost debt or paying college tuition. Learn more about how home equity works, how to calculate it, and how you can use it. More technically, home equity is the property’s current market value minus any liens, such as a mortgage, that are attached to that property.

To calculate your home equity, subtract your mortgage balance (and any other liens) from the property’s current market value. For example, if your home is currently valued at $400,000 and you owe $150,000, then you have $250,000 in home equity. The main advantage of a home equity loan, or second mortgage, is that all of the money is disbursed at the outset. Unsurprisingly, many borrowers who apply for a second mortgage have an immediate need for the entire balance.

No comments:

Post a Comment